Discover Affordable Mortgage Options with a Trusted Mortgage Broker San Francisco

Discover Affordable Mortgage Options with a Trusted Mortgage Broker San Francisco

Blog Article

Discovering the Services Used by a Home Loan Broker for First-Time Customers

Understanding Home Mortgage Kinds

When beginning on the trip of homeownership, understanding the different sorts of home mortgages is essential for newbie purchasers. Home mortgages are economic tools that enable people to obtain funds to acquire a home, and they can be found in numerous kinds, each with distinctive attributes and benefits.

One of the most typical kind is the fixed-rate mortgage, which supplies a steady rate of interest rate throughout the car loan term, normally ranging from 15 to 30 years. This predictability makes budgeting much easier for homeowners. Conversely, variable-rate mortgages (ARMs) include changing rate of interest that can change after a first set duration, possibly causing lower first repayments yet enhanced danger with time.

Another choice is the government-backed loan, such as FHA, VA, or USDA financings, which provide to details customer demands and often call for lower down settlements and credit rating. For purchasers seeking adaptability, interest-only mortgages permit lower first settlements, though they may result in larger repayments later on.

Understanding these home mortgage kinds equips first-time buyers to make educated choices that align with their lasting plans and economic goals. Engaging with a mortgage broker can supply useful insights tailored to individual conditions, additionally streamlining the decision-making process.

Assessing Financial Situations

Evaluating financial circumstances is a vital action for first-time homebuyers, as it lays the foundation for identifying affordability and appropriate mortgage options. A thorough assessment entails examining earnings, expenses, credit report, and cost savings, which jointly shape the buyer's economic account.

Credit history play a considerable role in mortgage qualification and rate of interest prices; thus, novice customers ought to obtain and evaluate their credit score reports. Identifying any kind of disparities or locations for improvement can enhance their economic standing when making an application for a finance.

Additionally, analyzing financial savings is vital, as it determines the dimension of the deposit and can affect mortgage terms (mortgage broker san Francisco). Purchasers ought to intend to have a minimum of 3% to 20% of the home cost conserved for the deposit, together with additional funds for closing costs and reserves. An extensive analysis of these elements will certainly equip newbie buyers to make enlightened choices in their homebuying trip

Navigating the Application Refine

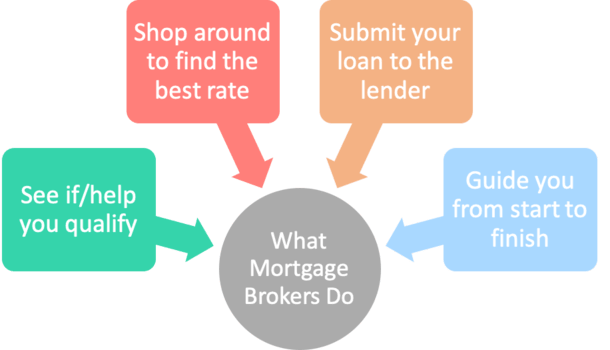

Navigating the application procedure can be a challenging experience for new buyers, as it entails a series of essential steps that need to be completed accurately and successfully. Home mortgage brokers play an essential duty in streamlining this trip, supplying vital support and assistance throughout.

At first, the broker will aid collect needed documents, consisting you can look here of earnings confirmation, employment background, and credit rating records. Making sure that all paperwork is organized and accurate is crucial, as any type of inconsistencies can cause delays or denials. The broker likewise helps in completing the home loan application itself, making sure that all called for fields are filled out correctly.

Once the application is sent, the broker serves as an intermediary in between the lending institution and the purchaser, keeping the lines of communication open. They proactively resolve any kind of concerns or problems raised by the loan provider, which can speed up the authorization process. Additionally, brokers often provide understandings right into possible contingencies or conditions that might arise during underwriting.

Comparing Lending Institution Options

After finishing the application process, newbie buyers have to assess numerous lender choices to protect the most favorable home loan terms. This essential step includes comparing rate of interest rates, financing kinds, and repayment choices provided by various loan providers. Each loan provider may provide unique benefits, such as reduced closing prices, flexible payment timetables, or specialized programs for new buyers.

Rates of interest play a critical role in determining the total expense of the home mortgage. Debtors must take into consideration whether a dealt with or variable price is extra advantageous for their economic scenario. Repaired rates provide security, while variable prices might provide lower preliminary payments yet come with prospective fluctuations.

Additionally, it is important to assess loan provider credibilities - mortgage broker san Francisco. Looking into client evaluations and scores can supply understanding right into their solution high quality and responsiveness. New customers ought to ask about any type of offered aid programs that specific lenders could supply, which can alleviate the monetary concern of purchasing a home.

Ultimately, a detailed comparison of loan provider choices equips novice property buyers to make educated choices, guaranteeing they choose a mortgage that lines up with their lasting financial goals and homeownership desires.

Offering Ongoing Assistance

Making certain newbie homebuyers feel sustained throughout their mortgage trip is necessary for promoting confidence and satisfaction. A home mortgage broker plays a pivotal role in this process by providing continuous assistance that click for source expands past the first loan authorization. From the minute purchasers reveal passion in buying a home, brokers are offered to respond to concerns, clear up terms, and address concerns that might emerge during the transaction.

Brokers likewise maintain clients educated regarding the various phases of the home loan procedure, guaranteeing they understand what to expect and when. This proactive communication assists alleviate anxiousness and permits purchasers to make enlightened choices. Brokers can aid in browsing any kind of difficulties that may arise, such as issues with paperwork or adjustments in financial situations.

Post-closing assistance is equally crucial. A competent broker will certainly adhere to up with clients to ensure they are pleased with their home loan terms and give guidance on future refinancing alternatives or modifications required for financial stability. By maintaining an open line of interaction and offering specialist recommendations, home loan brokers equip new purchasers, aiding them feel secure throughout their whole homeownership trip.

Verdict

In summary, home loan brokers play a crucial role in promoting the home-buying process for new purchasers. Their competence in recognizing different home mortgage kinds, examining economic circumstances, and browsing the application process improves the general experience.

Home mortgage brokers serve as essential allies in this detailed landscape, offering an array of services customized to reduce the problems of getting a home mortgage. mortgage broker san Francisco. A home mortgage broker plays a crucial role in this process by providing continuous aid that expands beyond the initial financing approval. A proficient broker will comply with up with customers to guarantee they are satisfied with their home loan terms and supply advice on future refinancing options or modifications necessary for economic check it out security. By keeping an open line of communication and offering specialist suggestions, home loan brokers empower newbie purchasers, aiding them really feel secure throughout their entire homeownership trip

In recap, home mortgage brokers play a crucial function in assisting in the home-buying process for new purchasers.

Report this page